Recently, Rupam, a good friend of ours, shared something interesting in a WhatsApp group we are part of. It was a simple question.

You have been given $10,000 to invest and you must choose only one of the two options (A or B mentioned below. Which option will you choose? Assume both options are safe.

Option A portfolio :

Invest $2,000 each in 5 different investments…where each of them give you an annual return of exactly 10%…so your overall annual return is exactly 10%Option B portfolio :

Invest $2,000 in 5 different investments where the individual annual returns are all different for each 5 component investment …some are negative…some are positive…but the arithmetic average of all these 5 return figures is 10%…(please note this 10% is NOT the overall return of the portfolio but just the arithmetic average of the individual return %s….so the overall annual return of the portfolio is different)

Example:

Investment 1: (16%)

Investment 2 : (- 6%)

Investment 3: (0%)

Investment 4 : (60%)

Investment 5: (-20%)

The arithmetic average of 16, -6, 0, 60 and -20 is (16-6+0+60-20)/5 = 10

Which option will you chose?

P.S.: Kindly do not worry about whether this is a real life scenario or not….the question can be answered with the information provided

Based on the statistics he provided, there were a total of 426 responses, with 59% of people choosing Option B, and 41% of people choosing Option A. Interestingly, some respondents have changed their responses after some discussions. Based on pure mathematics, Option B seems like the better choice.

However, while the potential return of Option B seems better at first glance, one has to account for the variance involved in the portfolio (remember that Option A’s variance is 0). For example…if the individual returns of the investments in portfolio B were 8%, 9%, 10%, 11%, 12% (still keeping the arithmetic average = 10%) then the value of Portfolio B would become ~ $26,131 in 10 years (which is > $25,937 for Portfolio A)….however if the variability increases significantly…as in the example (16%,-6%, 0%, 60%, -20%), the value after 10 years for Portfolio B becomes $232,017. In the above scenario, Portfolio A is always going to be the worst possible performing portfolio.

Some A respondents even justified their choice saying ‘they want to sleep well’…all they had to do is a simple calculation to realise that in reality their sleep would be sounder if they chose B…because most of the time B would perform better. I am probably not smart enough to explain this human bias but it could very well be people’s preference to think ‘linear’ instead of ‘exponential’ (and ignore 2nd order outcomes…longer term compounding being one of them).

However, there was another viewpoint that it may not just be a false sense of security. A calculation could be used in this example may exemplify that.

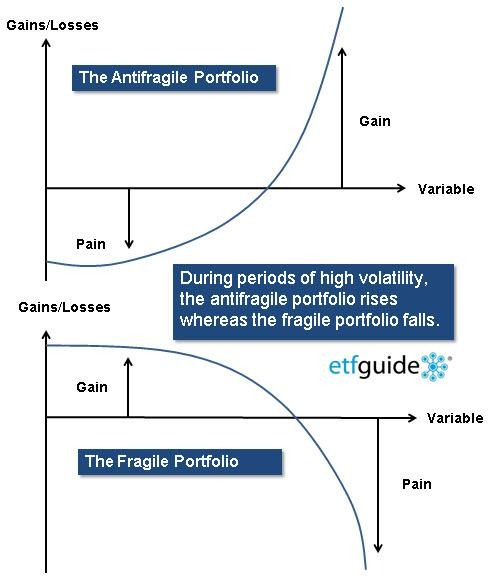

After that, a WhatsApp message in the group by Herbert (another good friend of ours), talked a little about variability. And it says “Just an add on, having variability is not always good compare to certainty as suggested. In fact, Nassim Taleb did point this out too. There is a key part you need as well which is the antifragile aspect otherwise variation could lead to huge loss.”

So, what is your choice? Feel free to share with us in the comments below.

Reference: http://moneywisesmart.com/portfolio-a-vs-portfolio-b-the-findings/