Note: This is going to be a constant series as I embark on my journey in Value Investing Mentorship. If you want to find out more, please email me at team@lancequek.vc. The author does not take responsibility for any factual inaccuracies made. Any opinions, conclusions, or other information expressed here is not financial advice. They are given on a general basis and are subject to change without notice. Your personal investment decisions are ultimately based on your financial goals, investment time horizon, risk appetite, and portfolio needs – which we do not advise. All information, data, and analysis here are provided “AS IS” and without warranty of any kind, either expressed or implied. Past performance is no indication of future performance; you are recommended to verify all information and consult licensed, professional financial services. The author does not take any responsibility for any loss or damage of any kind made based on the opinions or facts published in this document.

Sometimes, we tend to jump into things we don’t understand in the hopes of getting great returns in a short period of time. Greed and fear are the two key emotions that drive the market, and sometimes people overreact, which causes the market to be schizophrenic.

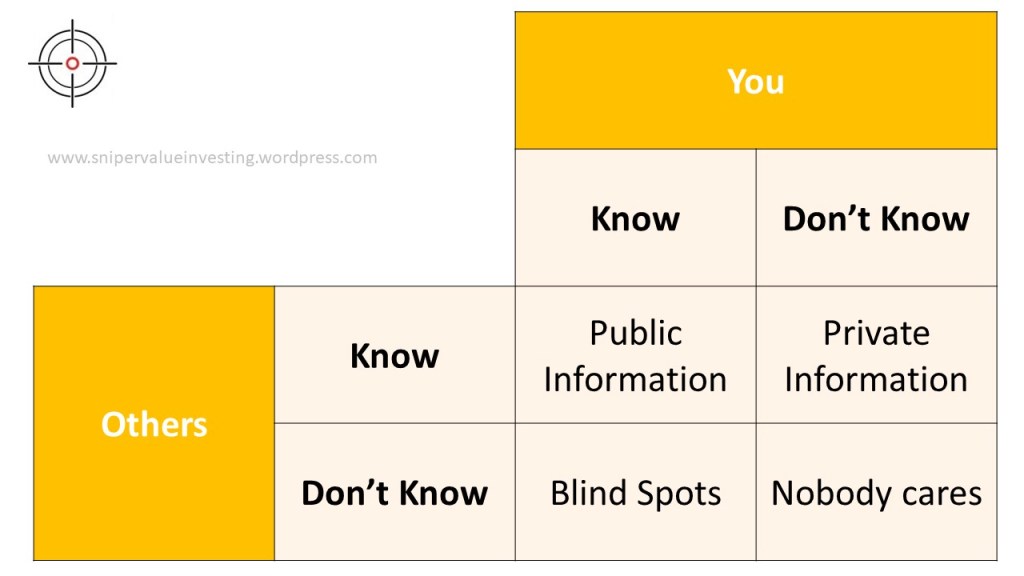

Being disciplined to stick to our Circle Of Competence, and it is important for us to know what we do and don’t know. I like to use the following diagram (modified from the Johari Window) to cover this:

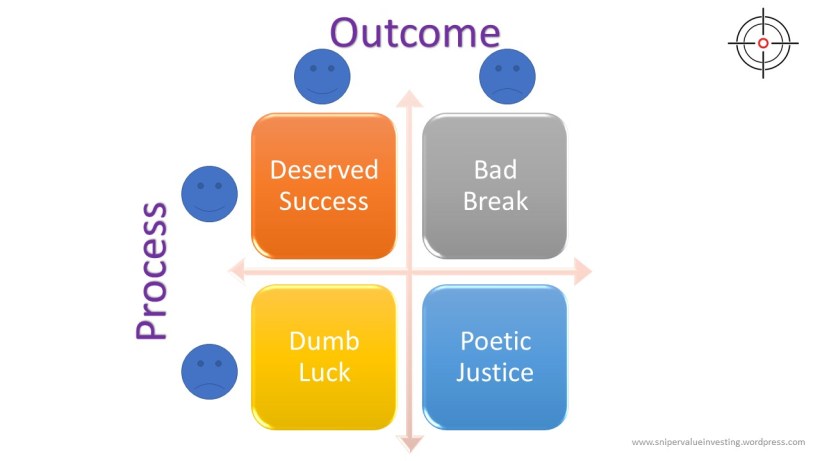

Sometimes, it is also about improving our processes over time to build a stronger and more resilient portfolio. In one of my previous posts, I mentioned the following matrix on Process v Outcome:

Now we will attempt to answer the following questions:

Why do you think it is not good to stay within your Circle Of Competence (COC)?

Sometimes, we tend to miss out on opportunities that we think we may be within our COC but actually are. This narrows down the number of companies that we could potentially select from. For example, if we don’t think companies in financial services is within our COC, we will more than likely exclude these companies from our selection, leading to a “biased” portfolio.

Why do you think it is good to stay within your COC?

If you understand a particular industry very well, you are more likely to have a rigorous process to evaluate whether a company is high quality or low quality and whether it is overvalued, fair valued or undervalued. This allows one to spot better opportunities within those sectors since different sectors will likely require different metrics. Would you trust a biotechnologist to evaluate whether a bank is in good shape? Probably not. Similarly, you probably won’t ask a banker to evaluate a biotechnology company if he/she doesn’t have any clue of how certain biological processes such as RNAi or antigen-antibody binding works.

Do you think, naturally, you are the type who will usually stay within your COC or not & why? What are you going to do or systemize to prevent potential future mistakes?

I tend to be someone who likes to explore different things (otherwise I won’t be an entrepreneur). Sometimes, it is important to watch myself when going into “unchartered territory” when it comes to value investing. It is about constantly reminding myself that there is a better opportunity another day. Like investing into the private markets, it is important to build my own due diligence checklist over time. We already have some of the quantitative models that we have built over time, and we will continue refining them as we go along.

How will you be influenced by fear and greed to make good or bad decisions in the stock market?

For me, I view investing in the markets just like investing into private companies. In fact, my brokerage account is a corporate brokerage account. In that manner, I think sometimes, it is more of watching what others are feeling in the market to know when a good time to enter is. Many a times, I have the tendency to “catch a falling knife”. I think that requires a lot of emotional stability to do. Again, it is about the psychological aspect of things that keeps me alive and well. Maybe that’s why being an entrepreneur is good because it takes away your attention from the market. Just leave it to ride as you have picked something high quality.

How can you use fear and greed for value investing and covered options selling purposes?

As mentioned, it is about putting companies of high quality into my watchlist and waiting for the falling knife to unlock the window of opportunity. Maybe it is time for me to start building some quant models to trigger price alerts as needed? Haha.

Jokes aside, fear and greed are emotions that create a schizophrenic market. Therefore, it is about leveraging on these emotions of people to make emotionally stable, sound and rational decisions when buying / selling securities. Sometimes, we just have to be cold and calculating when it comes with dealing on the market – who knows, AI might do a better job than us at that?

List the sectors or categories you think you understand and why?

- Healthcare/Biotech: I was a biotechnology/biomedical structural biology student in college. One of our key research areas was around RNAi and its effects on cancer. I had gotten a grant to work on bioremediation of plastics using genetic engineering back in my days in college.

- Technology: As a VC and technopreneur, I have been building and heavily investing into technology companies of the future in the private markets. With that, we have built a portfolio of at least 20 direct investments into privately held technology companies while also building a few ourselves.

List at least three companies you understand (a summary about the company) within your circle of competence (Morningstar).

Company name: Pfizer, Inc.

Sector or industry: Healthcare/Biotech (Pharmaceuticals)

Summary of the company: Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now, prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, cardiovascular treatment Eliquis, and immunology drug Xeljanz. Pfizer sells these products globally, with international sales representing close to 50% of its total sales. Within international sales, emerging markets are a major contributor.

Company name: Crowdstrike Holdings Inc. (Class A)

Sector or industry: Technology (Cybersecurity SAAS)

Summary of the company: CrowdStrike is a cloud-based cybersecurity company specializing in next-generation endpoint and cloud workload protection. CrowdStrike’s primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

Company name: Regeneron Pharmaceuticals Inc.

Sector or industry: Healthcare/Biotech (Pharmaceuticals)

Summary of the company: Regeneron Pharmaceuticals discovers, develops, and commercializes products that fight eye disease, cardiovascular disease, cancer, and inflammation. The company has several marketed products, including Eylea, approved for wet age-related macular degeneration and other eye diseases; Praluent for LDL cholesterol lowering; Dupixent in immunology; Libtayo in oncology; and Kevzara in rheumatoid arthritis. Regeneron is also developing monoclonal and bispecific antibodies with Sanofi, other collaborators, and independently, and has earlier-stage partnerships that bring new technology to the pipeline, including RNAi (Alnylam) and CRISPR-based gene editing (Intellia).