Disclaimer: The author does not take responsibility for any factual inaccuracies made. Any opinions, conclusions, or other information expressed here is not financial advice. They are given on a general basis and are subject to change without notice. Your personal investment decisions are ultimately based on your financial goals, investment time horizon, risk appetite, and portfolio needs – which we do not advise. All information, data, and analysis here are provided “AS IS” and without warranty of any kind, either expressed or implied. Past performance is no indication of future performance; you are recommended to verify all information and consult licensed, professional financial services. The author does not take any responsibility for any loss or damage of any kind made based on the opinions or facts published in this document.

We are going to embark on a new case study this month, Regeneron Pharmaceuticals Inc. This is a personal take on the company, and I am vested in this since 2019. This company has generated 128% returns since I invested.

Regeneron is a leading science and technology company that delivers life-transforming medicines for serious diseases. Founded by physician-scientists more than 30 years ago, our science-driven approach has resulted in nine FDA-approved medicines and numerous product candidates in a range of diseases, including blindness-causing eye diseases, severe inflammatory conditions like asthma and atopic dermatitis, hematologic conditions, pain and infectious diseases such as Ebola and COVID-19. In their 2021 in review, they have 9 FDA approved medicines, 30+ investigational medicines in clinical development and clinical trials going on in 55 countries. I see a lot of potential growth in this company due to the portfolio of drugs targeting major illnesses.

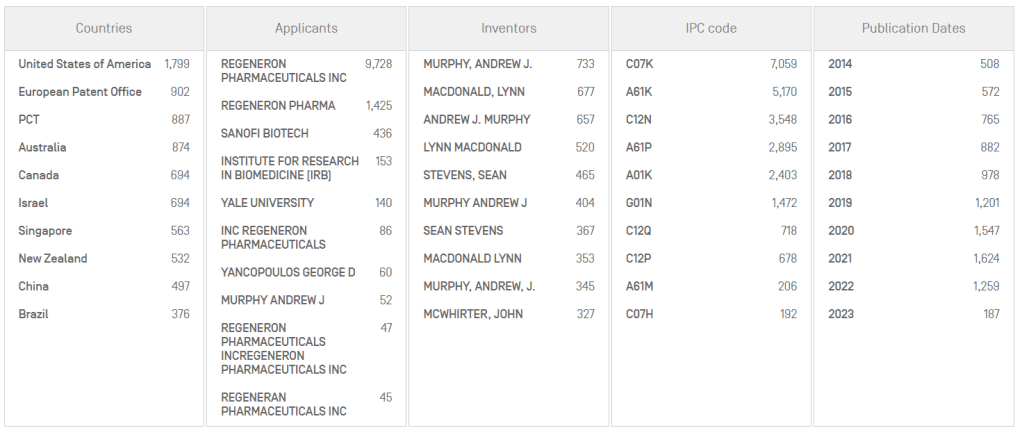

Their strong competitive advantage lies in the intellectual property that they own and their R&D efforts over the years. With 30+ drug candidates, it shows a strong pipeline for growth. Their patent portfolio spans across the world with more than 10,000 granted patents and/or applications. Every year since 2019, they had more than 1000 patents that were filed, showing their innovative spirit that is required to survive in the pharmaceutical industry. I would say with that kind of portfolio, it is a pretty strong moat that they have over time. Once the drug has been approved, they will be able to heavily monetize on the IP that they own in order to generate huge amounts of future revenues.

In terms of customers, I would say that their customer base will be mainly hospitals and pharmacies. Typically, clinics in the US would not be able to issue drugs directly, but patients will need to take their doctor’s prescription to a pharmacy, where they then get their drugs. Alternatively, they would have to get their drugs from the hospitals in the case when they are hospitalized. This typically means that they have a sticky customer base, especially since most of their drugs are approved for use by insurance companies, who would most likely foot the bill of the patients.

The company has recently reduced the ESOP program for their employees by about 20% per head, to better balance incentivization of growth and employee retention. This is their justification for their current pay structure:

As we can see, the management is quite receptive to investor feedback as far as pay structure is concerned, with a long term orientation to grow the company even further. The CEO only receives 5% salary as a risk-free compensation package, while all other incentives are driven by performance. This is compared to 28% of risk-free compensation in comparable companies. A majority of the compensation is tied to the company’s performance, which I believe is a positive sign for companies to follow.

The management is made up of mainly physician-scientists who have many years of experience in the field. The company is currently led by co-founders Leonard Schleifer and George Yancopoulos, which is something I look for as well (I have a positive bias for founder-led companies).

As mentioned, I see their innovative spirit as a very strong engine for growth. This is critical to push pipeline in the pharmaceutical industry. I like the fact that they are already doing so many clinical trials around the world for their pipeline, and look forward to them getting into global markets with their drugs.

Healthcare is an evergreen industry that never dies. New innovations are always needed to grow even further. Regeneron is well-positioned to capture the tailwinds of the less healthy population in America and around the world to grow beyond what they are today, and I can’t wait to break down their financial numbers in Part II of this case study.