Disclaimer: The author does not take responsibility for any factual inaccuracies made. Any opinions, conclusions, or other information expressed here is not financial advice. They are given on a general basis and are subject to change without notice. Your personal investment decisions are ultimately based on your financial goals, investment time horizon, risk appetite, and portfolio needs – which we do not advise. All information, data, and analysis here are provided “AS IS” and without warranty of any kind, either expressed or implied. Past performance is no indication of future performance; you are recommended to verify all information and consult licensed, professional financial services. The author does not take any responsibility for any loss or damage of any kind made based on the opinions or facts published in this document.

Today, we will be switching gears to look at dividend stocks. As I am based in Singapore, we will use a Singapore Dividend stock, Mapletree Logistics Trust. In this case study, we will only do a quick valuation, without going into the details of the company.

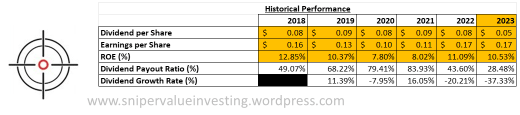

Here is the historical performance of the company:

If we were to look at a reasonable growth rate based on the formula ROE x (1 – Dividend Payout Ratio), then we will have a growth rate of 7.53%. However, considering a dividend growth rate of -37.33% in the trailing 12 months, we have adjusted this down to 4.72%.

We have also did some calculations on the fundamentals of three of the five REIT ETFs listed on SGX, and noted that the average 5 year NAV return for us is 1.38%. However, this is lower than our usual hurdle rate of 8%, which is what we are going to use.

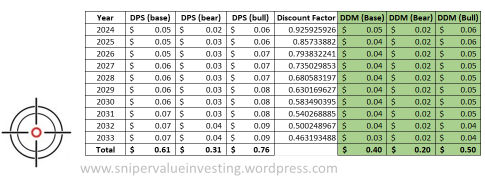

This sets up the following calculations:

Adding up all the discounted dividend values and using a (base, bear, bull) case probability weighting of (0.8, 0.15, 0.05) in the same way we did for Regeneron Pharmaceuticals, we yield an intrinsic value of $0.37, which is way lower than the current share price of $1.73. This suggests that the company is overvalued.